E-File Your Tax Return with RapidTax and Receive your Refund Within 21 Days!

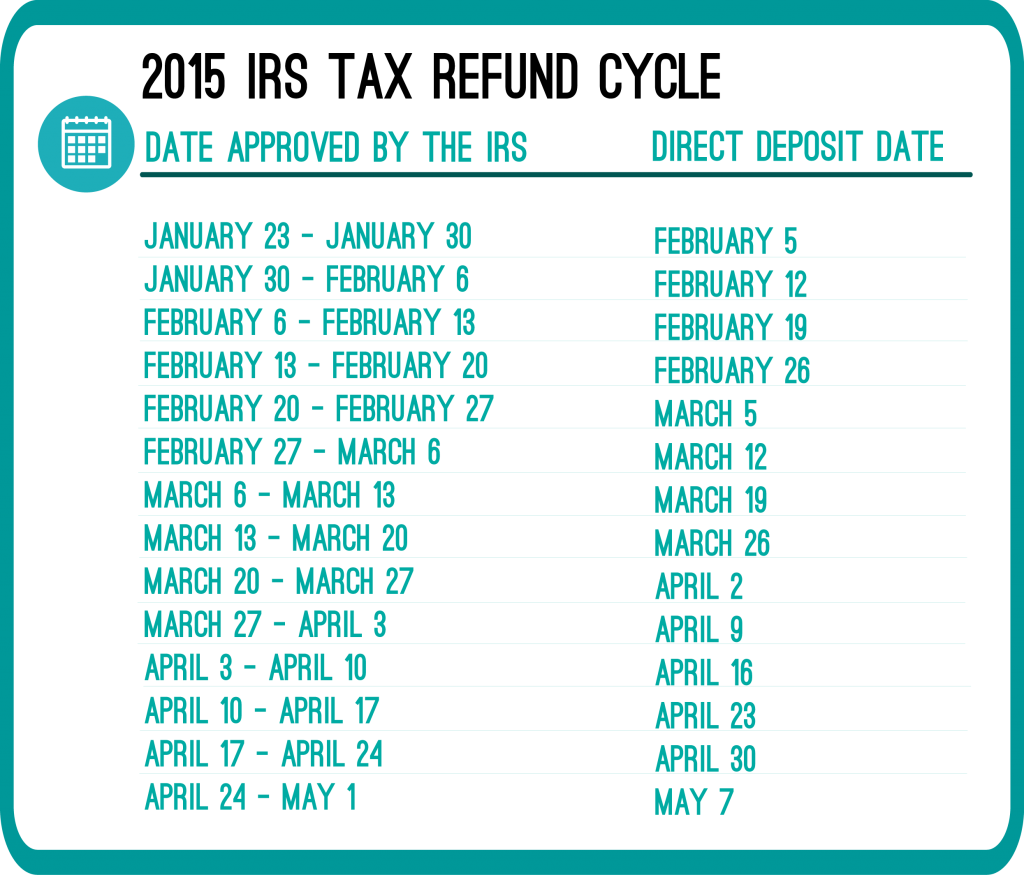

In the past, the IRS released a refund cycle chart. This chart allowed tax filers to know exactly when they would receive their tax refund. Sounds helpful, right?

Unfortunately, the IRS no longer posts the refund cycle chart. Luckily, there are charts out there which give a pretty accurate prediction on when you’ll get your refund.

You may want to know how long it will take to receive your tax refund once you file your 2014 tax return. Luckily, we’ve provided a refund cycle chart below.

Keep in mind however, these dates are NOT definite. They are only expected dates, based off of previous year trends.

Track Your Refund on the IRS Site

Once your 2014 tax return is e-filed, you’ll be able to track your tax refund using the IRS “Where’s My Refund?” tool. The site will give you status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear the RapidTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return!

Get Ready for the 2015 Tax Season

Tax Day (the IRS due date for 2014 tax returns) was April 15th. If you’d like to receive your refund sooner rather than later, it’s best to e-file your 2014 taxes as soon as possible with RapidTax!

So what are you waiting for? Create an account and get your 2014 Taxes out of the way today!

Photo via Chris Potter on Flickr

Does the irs where is my refund recognize 2015 e file return ? My preparer e filed my 2015 return was suppose to get a refund the sight says it’s not recognized I got my 2017 refund on Feb 25th 2018 back ???

Hello Joseph,

The tool only works for current year returns. You will have to call the IRS for prior year statuses. (1-800-829-1040).

My taxes were received Feb 3rd, and accpeted Feb 4th. I haven’t received my refund yet. According to the chart I should’ve got it the 12th.

Hi Mike,

As stated in the article, these dates are estimated based on prior year trends that tend to stick to the same pattern each year. The IRS used to release a chart similar to the one above but stopped doing this a few years ago. After 21 days has passed, the IRS does suggest calling them so that they can let you know how to proceed after doing further research. This is nothing to worry about and it does not mean that your refund is in jeopardy or incorrect.

My taxes were accepted on the 20th of January on where is my refund it said a direct deposit was sent to bank on Feb 5th and now it says there is a delay in my refund what can cause this

Hi Alizabeth,

Although most taxpayers receive their tax refunds within 21 days, delays happen and they are usually related to simple errors and oversights when entering your information. It could be a SSN mismatch, miscalculated refund/ tax due amounts, incorrect bank account information, etc. If this is anything to worry about and it is something that cannot be fixed without your assistance, the IRS will reach out to you, most probably by mail. If it has been 21 days since January 20th (when they accepted your return) and you still have not been updated on the status of your return, you should contact the IRS directly. After 21 days, they are able to research your return further to see where in the e-file process it is.

I filed my taxes with turbo tax on January 29th and my return got accepted by the IRS the same day right along with my state taxes the same day. I will have my check mailed to me. I was wondering what day or date should I be expecting my check to be mailed to me? If you can answer this for me. I would be oh so thankful. Thank you.

Hi Raymon,

Although your tax return was ‘accepted’, you are waiting for the IRS to ‘approve’ it. Once the IRS provides you with an ‘approved’ refund status, you will also receive an approximate date for when your return will be mailed out or direct deposited into your bank account (whichever you chose with TurboTax).

Hi,

I filed my taxes on April 15th, 2015 and I was told that I would be receiving a refund. I received a text saying that it was approved. When I checked my status today it said that it was received but hasnt been approved yet. Has anyone ever experienced this?

Thank you!

Hi Rachel,

The Where’s My Refund tool tends to lag a bit in updates, especially around the deadline date. If you receive a specific notice from the IRS, take that as the most recent update.