History tends to repeat itself.

We get it. To avoid false promises and tied up phone lines, the IRS stopped posting a refund cycle chart in 2012. Although the IRS won’t post a refund cycle chart anymore, that doesn’t mean that we can’t do a bit of research to estimate the dates that our refunds will arrive in our bank accounts.

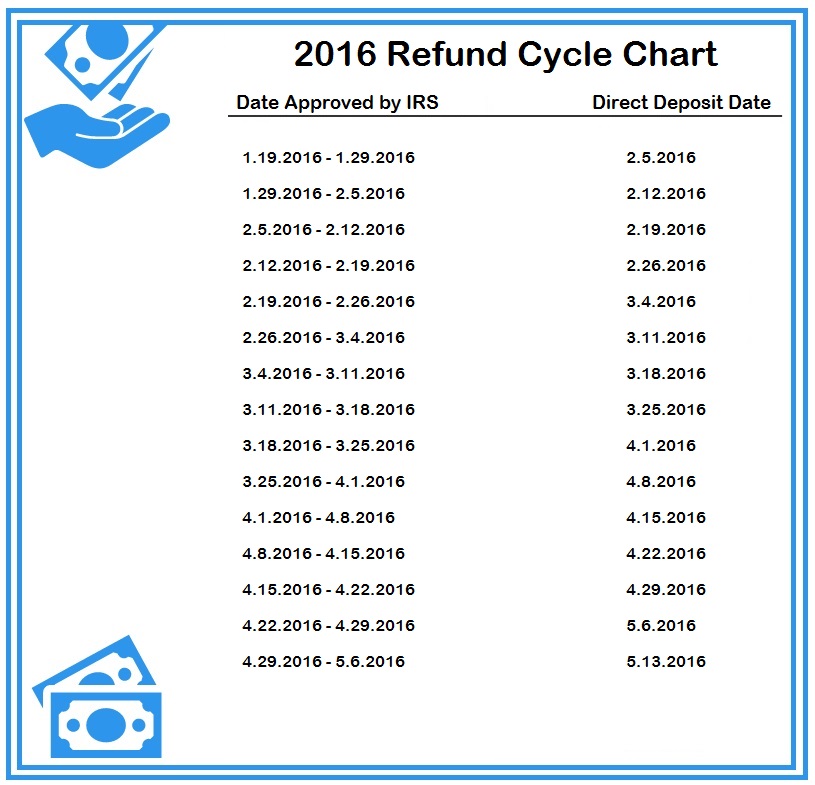

Whether you want to book a getaway with that special someone (…or your buddies), need to pay those bills that are piling up, or just have a firm grasp on your finances, knowing when you’ll be receiving such a large chunk of money is important. That’s why our team at Rapidtax has put together a 2016 refund cycle chart for you based on prior year trends.

Is there another way to check a tax return status after filing?

Yes. There is an alternative that can give you a bit more accuracy. The IRS provides taxpayers with the “Where’s My Refund?” tool on their website. Upon filing your tax return for the current year, you can check back to the site for a status update. In order to take advantage of this, you’ll need the following information:

- your social security number

- your filing status

- your expected refund amount

One of the few downsides of this tool is that you can only check the status of your most current year filed tax return. So if you were playing catch-up this year and filed your returns dating back from 2011, you’ll only be able to check the status of the most recent year that you filed.

Prepare your return online and get your refund ASAP.

At Rapidtax, we know that getting your refund as fast as you can say “TRIP TO TAHITI” is important. That’s why we offer the best customer support with our team of tax pros ready to assist you while you prepare your return online.The official start of the tax season is January 19th but you’ll be able to create an account with us before then and contact our team with any tax questions you have.

My refund is being sent by check on Monday 2/22/16. Does anyone know how long it takes to come in the mail? (got major truck repairs to do)

Hi Sunshine,

Tax refund checks are mailed via standard USPS so can take from 2-5 business days to receive based on where you live and where it is sent from.

Hi the irs accepted my return January, 27 2016

And I was suppose to get a refund on February 17

The where’s my refund bar disappeared and now it still being processed. I called and they said it’s still being processed, what do i do now

Hi Frantz,

It seems as though the IRS mistakenly gave you a refund date. This was a mistake on their end and there is nothing to worry about as it is now back in the processing stage. Check back daily for updates. If there is anything wrong with your return, you will be notified via mail and/or receive an IRS code on the Where’s My Refund tool.

I e-filed and the IRS accepted my return on January 23rd. The WMR site went from one bar to no bar on February 2nd. I received a letter from the IRS on February 12th saying that I needed to verify my identity. The letter stated that I could do it online or by phone. Since the letter said that it would be better if I did it online, that’s what I did. After answering the questions, the message said thanks for letting them know that someone else filed for a refund and that my refund would be terminated. I freaked out and called the number on the letter. After being placed on hold for thirty seven minutes I finally was able to explain what happened. The lady that I spoke with was very personable and was satisfied that I really was me. She informed me that it could take up to six more weeks to get my refund direct deposited into my bank but I should get it sooner than that. I have checked the WMR site but it is back to saying that my refund is being processed. I also check my bank but no refund as of February 19th.

Hi Tony,

I’m sorry to hear that you’ve had such a poor experience filing your taxes this year! Since you spoke with someone directly at the IRS, I suggest taking their advice and waiting out the 6 additional weeks for your refund. Once these 6 weeks has passed (since February 12th), I suggest calling back and speaking to a representative once more. It is not anything to worry about based on the ‘processing’ stage on the Where’s My Refund tool as it will be on this stage until you receive a direct deposit date update.

I filed and was accepted on the 20th of Jan.. I called and spoke to an IRS agent, had to verify my Identity on the 12th of Feb. The WMR has been showing ” Refund is still processing, will get refund date when available”. How long will I have to wait for my refund after my identity has been verified. Please help!!!

Hi John,

The Where’s My Refund tool is updated daily. If you do not receive an update within 2-3 business days, I suggest calling the IRS back. It is over the 21 day threshold that they instated and they should be researching your status further.

Hey we file our taxes on Feb 4,2016 and t still saying received what’s going on

Hello Victoria,

This means that the IRS has received your tax return and it is in the processing stage. They insist that you allow 21 days if you e-filed your tax return. You can check the Where’s my Refund tool daily as they update each day. After 21 days, the IRS will further research your tax return progress if you contact them to do so.