Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

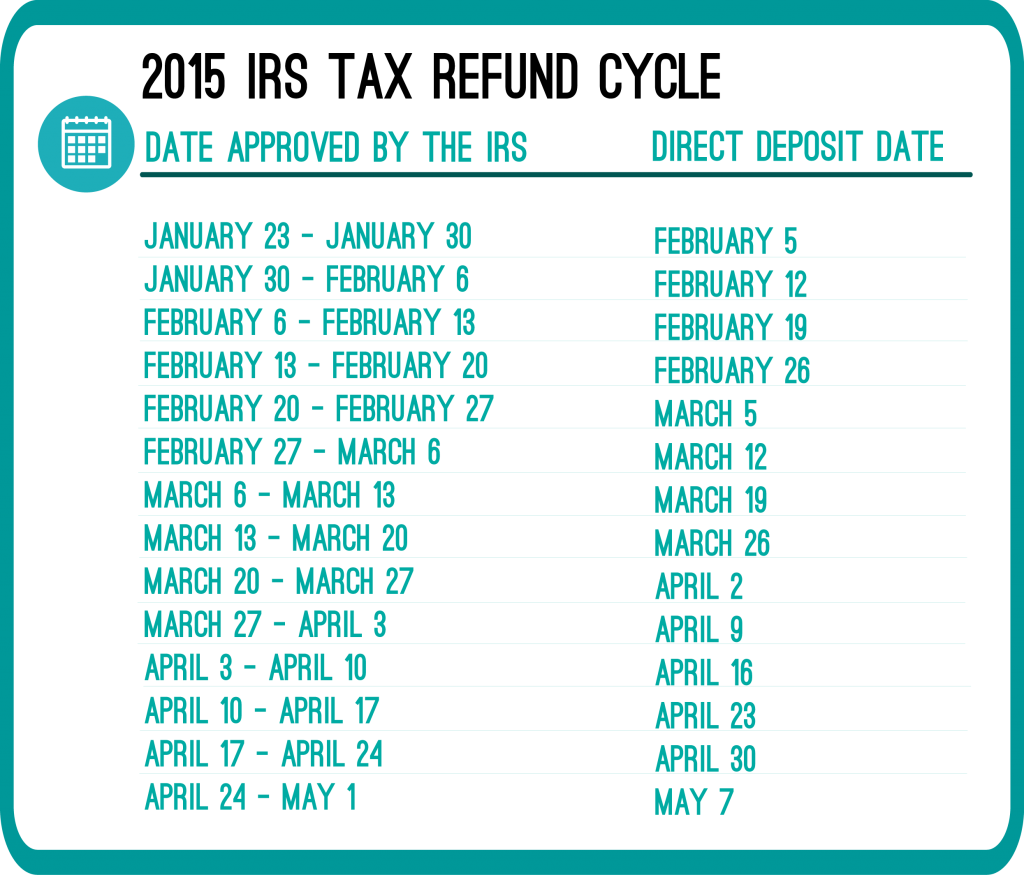

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

My e-filed return was accepted yesterday, 01/28/14. I am not a business (and did not file as one), nor is it a past years return. I got an email update yesterday that the return had been accepted – despite the IRS website saying they will not begin accepting returns until 01/.31/14. So it appears that although it states differently on the website, they are indeed accepting returns already. I have read of some people who had theirs accepted on 01/24/14. IRS website shows this when I check for status:

We have received your tax return and it is being processed.

You should get your refund within 21 days from the date we received your tax return

Thanks for the helpful information! Although the IRS previously stated they will not start accepting e-filed returns until January 31st, the latest news is they are (as you said) accepting e-filed returns a few days early.

My taxes was accepted on the 24th and it says they are being processed but it does not show being approved yet .Are they waiting on the 31st and will I have to wait until the 13th for my refund ?

Hi Sally,

Yes, that is correct. The IRS will not start processing e-filed returns until the 31st.

I was aware that the IRS said it was not accepting returns untli Jan. 31 but I filed with H&R Block electronically on Jan. 16 anyway. I fiured earlier wasn’t going to hurt me and it would be already done. Despite the Jan. 31 start date, I checked the IRS “Where’s My Refund” site and it says the IRS had accepted my refund on Jan. 25 and then Jan. 28 and was processing it. The fact that it gave 2 different dates may be odd but what is even more odd is that it is showing my return accepted BEFORE Jan. 31. Has this happened to anyone else?

Hi Martha,

The IRS threw a curve ball and just started accepting e-filed returns (a few days early!). However, it’s good to know although the IRS is now accepting e-filed returns, they will not start processing them until the 31st.

The IRS has already accepted my return as well as a few others who have e-filed already. I used TaxSlayer, and they submitted my return early. Also, my info on the Where’s my Refund site shows that the IRS is processing it.

Hi “Hardworker”,

The IRS threw a curve ball and just started accepting e-filed returns (a few days early!). However, it’s good to know although the IRS is now accepting e-filed returns, they will not start processing them until the 31st.

That’s not true. Been accepted early 3 yrs in a row all times had it before Feb 1st.

You DID mean 2 say JANUARY 31st and not MARCH, right? 🙂

Thanks Lori!

I submitted my taxes january 21st 2015 was this to early to file

Hi Ola Mae,

The official start date for this tax season was January 20th so you were right on time!

Mines got excepted on Jan.30 I do not have a date. When will I receive a date today is Feb.16 2014

Hi Erica,

If it was accepted on Jan. 30, I would wait 21 days to receive a date. After 21 days, I would contact the IRS directly, to ask what is going on with your return.

My boyfriends was accepted today, so where does that leave him on when his will be refunded? He filed on January 3rd and was pending until today. Checked wmr and it showed was accepted.

Hi Kendra,

He will probably receive his refund by mid-February.

i tracked my tax refund and shows refund sent on the 5th of March and till now,no fund has been deposited in my account.i dont seem to understand this plan.Could you please advice?

We have released the 2014 Tax Refund Cycle Chart on our webpage RefundSchedule.com.

For more details, visit http://refundschedule.com/2014-irs-e-file-chart/ .

Thank you.

-Andrew

Awesome. Thanks Andrew!

Hi, my refund status is sent as of April 7th…. Now I know it can take up to 21 days? But my question is, what is the “average” (likely date based off others) time frame I may recieve my paper check in the mail. I live in tacoma wa. Thanx so much in advance!!

Hi T Vania,

I would suggest keeping an eye on the IRS “Where’s My Refund?” tool. Once your return gets to the second step of the process, they will let you know the exact date they are sending out your refund. I wouldn’t expect to receive it before the 21 days is up, considering you need to keep in mind that the mailing process takes time.

Just for future reference, if you have your refund direct deposited next year, you’ll most likely get your refund much faster.

So I called they said mines was pressed April 7th wat does that mean is they sending me a check this my 1st time paper filling help lol

Hi Thomasina,

IF your refund was being processed on April 7th, that means you will get your refund within 21 days. I would expect to receive your refund by the end of April.

Mine was accepted on April 7. Straightforward, no dependants, EZ form, filed electronically, direct deposit. The state mailed it’s refund in a week. It’s May 8 now, and I’m still getting the “received/processing” message from Where’s My Refund. Disgusting. There’s nothing in my filing that should red flag it. There’s no explanation why it should take over 5 weeks. The IRS refund site is useless. Last year, the refund was deposited in my bank and the status NEVER changed. Calling is also a waste of energy, they just look it up the same way and tell you exactly what’s on the screen … it’s been received and is processing. As for the lame explanation, they are pulling random returns to check for whatever, it’s more like they are pulling random returns to process. The IRS refund status site is just to give you something to do while they sit on your return. Every year, it’s the same thing I file electronically, simple return, and it takes them forever to process it and get my refund back to me. It’s typically taken over 8 weeks to get my refund, since I’ve been filing electronically. My inlaws however, are the biggest mess of a return I’ve ever seen, and they always get theirs within two weeks. That’s fair.

Hi Lawrie,

Yes, the IRS can take much longer than anticipated and it can be very frustrating.

This is so frustrating! We have filed on time, got a letter in May saying that the process is taking longer have to wait until July 1. Still heard nothing, contacted the tax advocate sent in our whole return again to the tax advocates, even though it is in the IRS system! Now the where’s my refund site will not even let me look, keeps saying it is unavailable after I put the info in!

Hi,

I highly suggest contacting the IRS again. Since the “Where’s My Refund” tool is not providing you with an accurate answer, getting in touch with an IRS representative is the next step.

I filed my tax on the 1st of feb and o was accepted the same day and they said i have til feb 21 to get my refund but when i went to “where my refund” it say its still proccessing. And i want to know when will i get a dd. And when i check your calender it say i should get feb 13 but i still have no dd. Please help

That’s the same thing it tells me. They accepted my return on Jan.31 and it still tells me it’s being processed. But the chart say Feb.13 to be deposit, so I don’t know what to go by.

Hi Brown,

There are three stages of refund claims for the system. 1. Return Received, 2. Refund Approved and 3. Refund Sent.

Your return has been received, which means it is being processed. Once the IRS has completely processed it, it will be approved and the status will change to “Refund Approved”. Then, they will send your refund by direct deposit or check. Once sent, the status will change to “Refund sent”.

The chart is just as estimate refund date based on previous year trends. The IRS issues most refunds in less than 21 days.

ok.. I had 1 bar that said accepted and on 2/8/14 it has gone to NO BARS. this is what is printed “Your tax return is still being processed.

A refund date will be provided when available” is this normal? I was accepted on 1/29/14.

Hi there,

Yes, that’s fine, it can take up to 21 days for your return to be processed. Once your return is approved that means the IRS is actually preparing the refund to be sent out. We actually have an article about the refund status updates from the IRS and what exactly they mean.

my husband and I filed feb 4 and efile wa accepted on the 5th. on the wmr website it still says accepted and processing. it’s never taken this long to be processed before. why is it taking so long, my tax lady is telling me once my efile is accepted it’s been processed. I know ppl that filed after me and already got their return. is there possibly something wrong? if there was something wrong wouldn’t my efile had been rejected?

Hi Terra,

It can take up to 21 days. With that said, as long as the IRS website is displaying your return was received, that’s what matters most right now.

It’s frustrating when you need the refund and it’s taking longer than expected, however, the IRS has only stated that 9 out of 10 tax-filers will receive their refund within 21 days. Your tax lady can check to see if your refund was rejected, but it’s my guess that the return is simply taking longer than usual to process.

I mean we get all that info but yet in still we are still not receiving funds in our accounts when it has said to be deposited

Hi Regina,

As the article and table states, the refund cycle dates are only estimate dates and based off of prior year trends. The IRS only states that 9 out of 10 refunds will be processed within 21 days.

i tracked my tax refund and it shows sent on 6th of March and up till now i didnt receive any deposit in my account.What do i do now cause i dont seem to understand this process?

Hi Natacha,

I hope you received your tax refund by now. If not, I suggest contacting the IRS directly by phone and let them know of the issue.

Hey i filed my taxes on March 6 it was said that it was accepted

that same day. Now my problem is that its April the 15th and My refund

status still says your refund is being processed an a refund date will

be available blah blah with no bar. I cannot find a number to call an talk to an

actual representative i keep getting voice recorded stuff an really need answers

how can i contact someone to ask what’s up?

Hi Salina,

That’s super frustrating. Considering 21 days has passed since you filed your return, you can call the IRS directly at 1-800-829-1040 and one of their representatives can research the status of your return.

This is so frustrating! We have filed on time, got a letter in May saying that the process is taking longer have to wait until July 1. Still heard nothing, contacted the tax advocate sent in our whole return again to the tax advocates, even though it is in the IRS system! Now the where’s my refund site will not even let me look, keeps saying it is unavailable after I put the info in!

We file our taxes on April 16 with injured spouse how long before we will hear anything? I’m the one who owes money and a granddaughter whom I’m raising. I have legal guardianship of her. How will they figure how much refund we will get back he made most of the money.

I filed my taxes on 1/20/2015 they were accepted on the same day. I want to know why I don’t have a date when my refund will be back. All the internet says is still processing. My 31 days are up on Tuesday.what is going on can you help me. Plus I did direct deposit to my bank.

It’s very frustrating because its like everyone from the people who did my taxes and the I r s. They both are putting the blame on each other. I never have had this problem before. Can someone please just give me some real truthful answers.

Hi Alicia,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.