Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

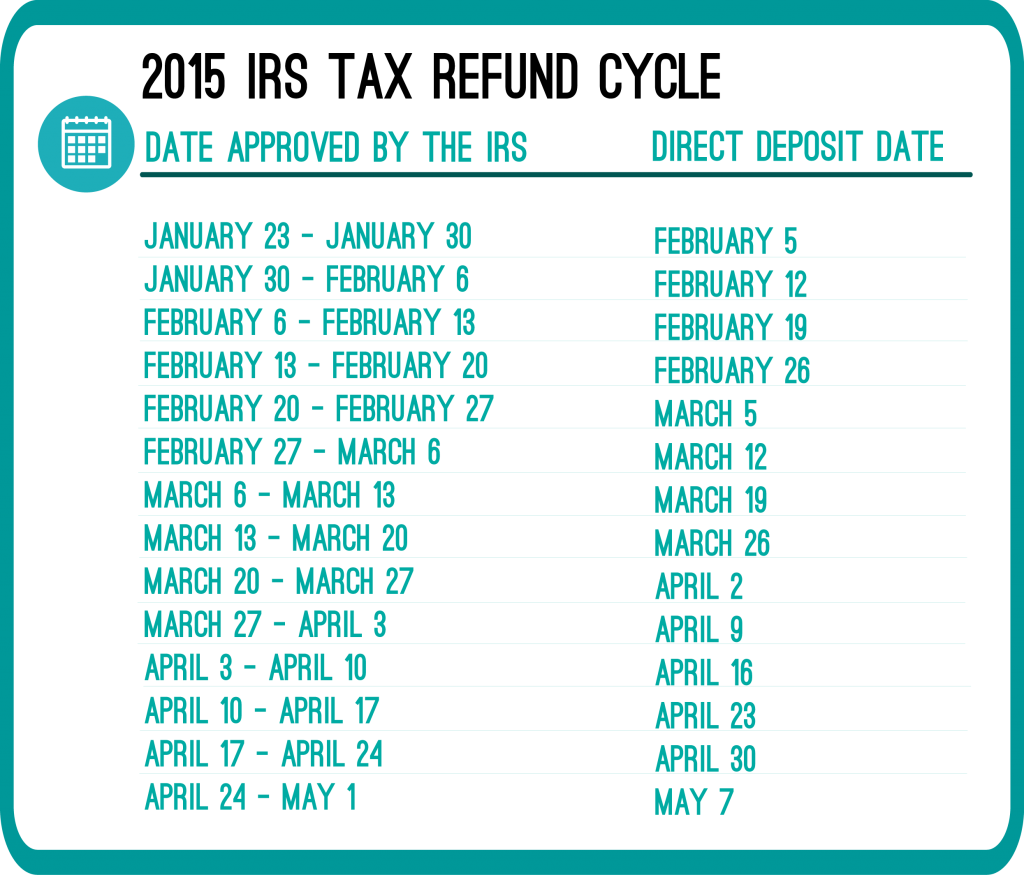

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

I was told by Jackson Hewitt that they sent my return on 01/24/14 to the IRS. They told me that b/c i was in the first batch that the irs eill process my return on 01/31/2014,& i can check my status on 02/01/2014 ,& that i can have my refund deposited as soon as 02/03/14… I hope this is accurate….

I don’t know the procedures for Jackson Hewitt, just for RapidTax. I do know however, it usually takes the IRS around 21 days to process a refund. That means it would be more accurate if you were told you are getting your refund around mid-February.

I e-filed mines on the 29th of January…and was process and accepted the next morning and just checked the WMR site and predictionfor my refund is estimated for Feb 20th. Now is that the IRS extra lead way with that date? Can i look forward for it to comeas early as the 13th?

Hi Lelani,

Your refund could come before the 20th, but I wouldn’t plan for that. Plan on getting it around the 20th.

Hi ,I filed mine on the 31st and my was sent on the 4th my check will be here on the 20th

I filed my taxes on January 8 2014. They were accecpted on january 13 2014. When do you think I will have an ideal when they will be here

Hi Cynthia,

The IRS notes on their website that refunds will be processed in a time period of approximately 21 days. Here is a link to the IRS website regarding receiving your refund.

My ddd is feb 7th

Hey what date did you file and when did it get accepted ?

I am a CPA, not a “tax preparer” and it is absolutely possible to have your regular, personal, 2013 taxes accepted prior to Jan. 31st. The IRS nearly always accepts small batches as test runs, and some people will inevitably be in those batches. The IRS dates are also “government dates” which are NLT, or Not Later Than, meaning it is entirely possible they will begin accepting returns slightly before Jan. 31st, but they want to give themselves enough cushion and not make everyone panic. Just an FYI, I do not do independent tax preparation, so I don’t have any dog in this fight as far as taking business away from anyone, just trying to get information out there.

Hi Tammy,

Thanks so much for your helpful information! Yes, the IRS is now accepting e-filed returns. Happy tax season!