Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

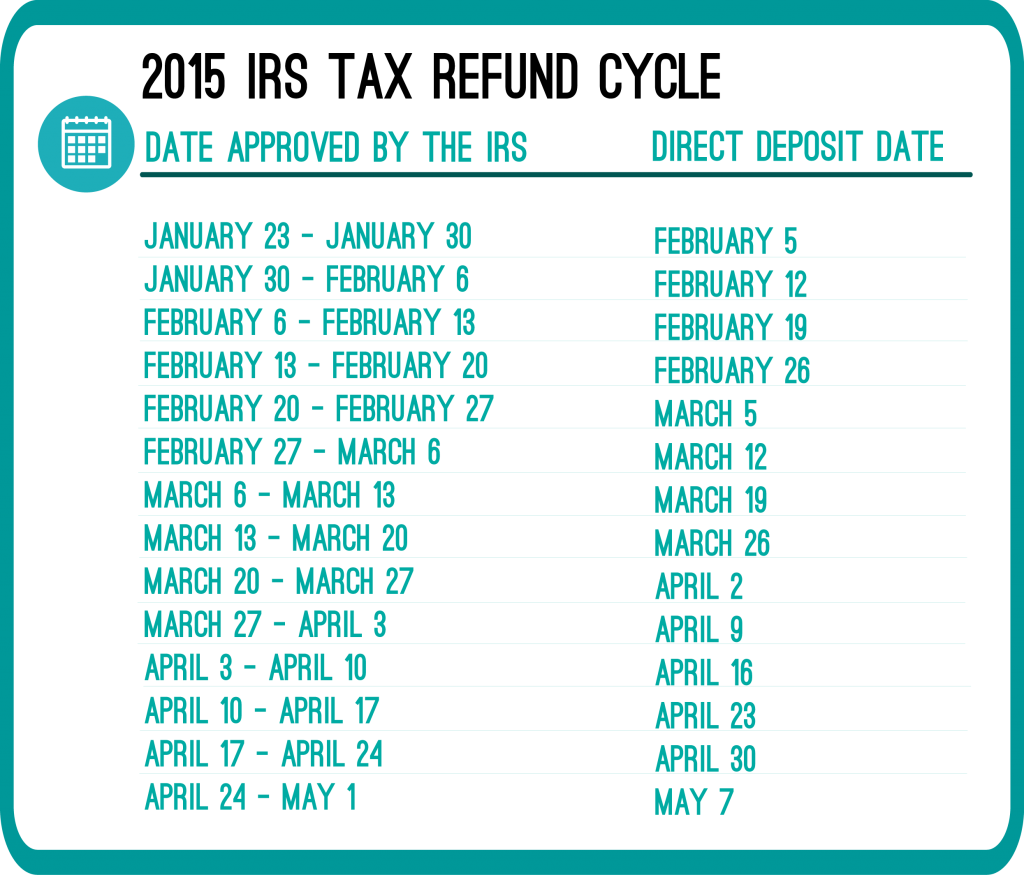

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

My return was filed Feb 1st. It got accepted right away. Every day I checked it said processing. Up until two days ago that is. Now it keeps saying I entered the information wrong but I know it’s right I checked daily from the day I filed. Entering all the same information. What could that mean?

Hi Isabela,

If you received this message, try refreshing your browser and even using a different one. It could just be a glitch in the IRS tool or that you were checking your status more than once daily. After 21 days, you can contact the IRS directly so that they can further research your return status. This may be necessary if you are still unable to use the Where’s My Refund tool.

Can someone help me. The online status on Where’s my Refund has forever been saying “still processing” since February 2015. I really want to talk with an IRS representative but can’t seem to find a number that will connect me to one. I just want to know what’s going on! This is so frustrating!

Hi Suzy,

I definitely understand your frustration. Contacting the main IRS phone line representatives can be time consuming and almost impossible. I suggest contacting your local IRS office. The representatives there have access to the same database and should be able to offer you some answers about your tax return status. Once you are on the website, choose your state and you will be shown a list of offices near you.

I got accepted on January 23 2016 when should I be looking for my tax refund and I know it says 21days but I need a date

Hi Rere,

Please note that being accepted by the IRS is different than being approved by the IRS. Once you receive a status update that your return has been approved, the IRS will provide you with a more exact date of when you will receive your refund. If you chose to receive your refund via direct deposit, feel free to take a look at our Refund Cycle Chart for 2016 HERE. Although the IRS no longer provides estimate dates, we have acquired these dates from prior year trends.

Mines was sent out march 6 2015 still no check I went to the website so where is my refund!!

Hi Stacie,

If you call the IRS at 800-829-1040, they will provide you with an update on the status of your refund.

Alternatively, if you filed with RapidTax, feel free to reach out to our tax team via your account’s message board or by phone.

Still haven’t receive my refund I file them on Jan.22 and it still being process

Hi Jessica,

I know that it can be beyond frustrating when waiting for your refund. Since it has been over the time frame provided by the IRS, I do suggest giving them a call (especially because you are also not receiving an update on the Where’s My Refund tool). Keep in mind that it is the middle of tax season so the volume of returns coming into the IRS’ database is extremely high which could be causing an update delay.

Still have not received refund still says being processed when originally I had one bar going on a month now no letter or contact request I filled my return at the end of January… should I be concerned other than the fact everybody else I know has gotten there return?

Hi Shawn,

It’s very understandable why you feel that way. Considering that it’s been over 21 days since you filed your tax return, I would suggest contacting the IRS directly. Their phone number is 800-829-1040. If you filed your tax return with RapidTax, you can first reach out to our tax team via phone, chat or email support. They will be more than happy to help you out!